The far-Left president of Brazil, Lula da Silva is in the headlines after a week ago he said the following:

Why can’t an institution like the BRICS bank have a currency to finance trade relations between Brazil and China, between Brazil and all the other BRICS countries? Who decided that the dollar was the (trade) currency after the end of gold parity?

After him, the president of Malaysia (who?!) uttered something similar and, from there on, the Cyrillic and idiograms-coughing shills started shilling. Tens of millions of words consisting of panic porn for Western audiences and hopium for ‘eastern’ audiences have already been written.

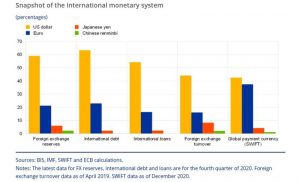

Both formats of shilling (which, by the way, is very profitable for moneyed interests) have cited some true facts – such as the dollar now representing 58% of the global reserves, down from 73% in 2001. Or the fact that the Biden administration’s fiscal policies suck.

Now, all of that is true, but does that mean dedollarization is actually happening? And if yes, at what pace? And, unless you’re a CCP shill, a Russophile or a moneyed entity (e.g. hedge fund), how is that likely to affect you?

Well, the answers are simple, but not easy: Dedollarization isn’t really happening; at the current pace (deemed “alarming” by panic porn) the yuan/renmibi will need 120 years (best case scenario!) to reach parity with America’s most profitable export. And, if you’re not a huge entity, it’s quite unlikely this will affect you in any relevant ways anytime soon (if over the age of 40 – at all in your lifetime, statistically speaking).

Graphs and numbers

Graph as of February 2023

Whatever your political opinion or preference concerning dollarization or dedollarization, one has to be mindful of reality.

(De)dollarization happens when enough players in the global market (both large and small) decide to trade or to no longer trade in Uncle Sam’s green notes.

While it is true that the share of dollars used for trade declined a bit in the last 12 months (as seen on the graph), that decline is mostly in favour of the Euro and the Japanese Yen, and not in favor of the renmibi/yuan, which is the only potential serious competitor (more on that further down).

This reality can be framed in propaganda terms as an inherent strength of the US dollar (which may very well be the case, though impossible to know just yet) but the more likely explanation is that the only entity that really started to use yuan/renmibi is the government of Russia. The entire economy of Russia was smaller than Italy’s before the escalation started in February 2022. Today, it’s smaller than that (though still unclear how much smaller). Of that whole pie, the government is a big player, but no more than half. The other half – the Russian people that is – continues to queue at banks for dollars and euros. And even most Russian state companies continue to hoard dollars a lot more than yuans.

So, in the end, the share of yuan/renmibi in the global trade shouldn’t have increased by much and, indeed, it did not.

Moreover, with all of the belt-and-road initiatives and other predatory loan schemes that the CCP has launched over the last decade, the share of yuan in the global debt is still to be rounded down to its nearest integer – specifically zero.

Moreover, with all of the belt-and-road initiatives and other predatory loan schemes that the CCP has launched over the last decade, the share of yuan in the global debt is still to be rounded down to its nearest integer – specifically zero.

In other words, statistically nobody takes a loan in yuans. Not even Chinese semi-private otherwise huge entities such as China Construction Bank Corp. or Tencent Holdings. Even those prefer to take their loans in dollars.

Even Chinese companies who are in the business of financial predatory practices in Africa still denominate most of their stuff in US dollars, pound sterling or the local currency (which is routinely pegged with the euro or the US dollar).

Now, all of these entities could in theory decide to no longer do that. But they don’t. And won’t anytime soon because…

The CNY/RMB dual system

The vast majority of the people who write about this topic fail to mention this fundamental aspect: China has three currencies: The renmibi, the yuan and the digital yuan. Each with its own exchange rate, degree of convertibility, capital controls applied on it and a plethora of other issues.

If you have a $5 bill and you’re hungry, in more than 180 countries on Earth (including China, Russia, North Korea or Turkmenistan) you will eat something in exchange for the $5 bill. Someone will trust your $5 bill enough to give you something to eat in exchange for it. Does this hold true for the ¥50 bill? We all know the answer: and it’s a resounding NO.

The reason is not (necessarily) a geopolitical one. It’s not that most people on Earth hate China necessarily. After all, the same holds true with the Uzbek Sumy or the Zimbabwean Bond. Also, if geopolitical opinion or hate would play a role, then surely CCP and FSB officials wouldn’t be holding their own savings in US dollars.

Also read: Somali Shilling hits record 15 years high

The reason is much simpler: Convertibility. Uncle Sam’s greens are trustworthy enough to be convertible almost everywhere, almost all the time. And if you get a $50 bill in Russia and fly to Capetown, you know you can spend the $50 there too. And if you want to use it to buy American goods or services, that’ll do as well. Nobody cares you got the $50 bill in Russia. None of this holds true with the yuan.

The yuan (CNY) only exists internationally. You can use it to buy goods or services from places outside of Mainland China that also happen to accept CNY (which,… aren’t that many). If you fly to Beijing and want to use it, you first have to convert them into renmibi (RMB) which is the “people’s currency”. Depending on the amount, the degree to which the CCP despises you and your social credit score, this process may be denied to you. Imagine not being able to use your legally earned dollars in the US because you earned them in another country. This is the reality for holders of yuan.

And then there’s the digital yuan which is a form of CBDC with the worst negative aspects of it and none of the benefits. CBDCs should be convenient and easily convertible but the digital yuan is anything but.

Now, that’s not to say that the yuan couldn’t, in theory, in some future, replace the US dollar as the global currency. It could. But this yuan, as it stands now, won’t. For sure. And reforming this mess can’t be done in under 10 years and the necessary reforms won’t be made anytime soon anyway because Xi Jinping and the CCP show no interest in that (assuming they have the competence, which they might).

BRICS currency? Fun fact: NO

Beyond the yuan, there is no other potential competitor to the US dollar.

The yuan at least has the theoretical possibility of giving a shot because it comes from a large industrialized economy – but the internal dysfunctionalities of the Chinese economy are preventing this. In short: socialism is still bad for business.

In fact, given China’s size, it is indeed quite remarkable how low yuan’s share of trade financing is. As the world’s largest goods-trading nation, the CNY’s share should be bigger, but it’s not. Because internationalizing the currency is a complicated process which involves reforms that the CCP is either unable or unwilling to implement. For this reason alone (even disregarding all the other practical and financial reasons) the continued status of the dollar as a reserve currency is all but guaranteed.

The next competitor would be the Euro. But the Euro is the currency of a disparate group of 20 states with varying fiscal policies, debt, and equity markets that also suffered a significant sovereign debt crisis a little more than a decade ago. It’s the currency that tried to have inflation for years – and then got all of the wanted inflation all in one fell swoop in a single year, triggering a cost of living crisis that has still not resolved.

The chances of the Euro becoming the alternative for the US dollar in ways that matter globally are quite slim. But even if that were to happen, most €urozone countries are US allies so what you’d get would be DINO (Dedollarization In Name Only). In the end, roughly 84% of world trade is in US dollars and 6% is in Euros. And the Euro as a unified currency has been around for 24 years.

Now imagine a BRICS currency – which would be the currency of a disparate group of at least 5 states with varying fiscal policies, debt, equity markets and economic visions and models. Personally, I would love to see such an experiment attempted. The shitshow that the €uro is would look like an orderly and civilized currency compared to a BRICS currency. Though, upon further thought, such an experiment would deeply harm almost 2 billion people so… it’s better if this is not attempted.

One thing is certain though: a BRICS currency would not threaten the US dollar’s dominance basically ever. For roughly the same reasons the Euro can’t either.

B-b-but crypto?

One tool cited for advancing dedollarization are digital currencies – be them CBDCs or cryptocurrencies.

Well, just like with the Euro and the hypothetical BRICS currency – this is quite unlikely. CBDCs barely exist and are already encountering plenty of issues. For them to reach the level of trust of the people necessary to convince enough people and entities to switch to them from the US Dollar… that’s many decades down the road, if ever.

With crypto, things are even wilder. Bitcoin, barely used as a medium of exchange, saw its value in dollar terms collapse by 75% from late 2021 to late 2022 before bouncing back in April 2023. If you think enough people would be willing to denominate their real-world assets in electronic gobbledygook that varies so wildly that makes the Great Depression fluctuations look like a walk in the park… if you believe that, I have a nice beautiful bridge in Malmö for sale.

Cryptocurrencies have proven themselves to be a great speculative asset but… that’s about it. Cryptobros would argue that it’s a good store of value, but that’s a more complicated issue and quite far from the promises of the crypto evangelists (and yes, they unironically call themselves that).

But even if we grant that (at least some) cryptocurrencies are decent stores of value, that still doesn’t make any of them potential competitors for the US dollar anytime soon. When I’ll be able to take my satoshi and buy bread with it right now, then we can start that conversation.

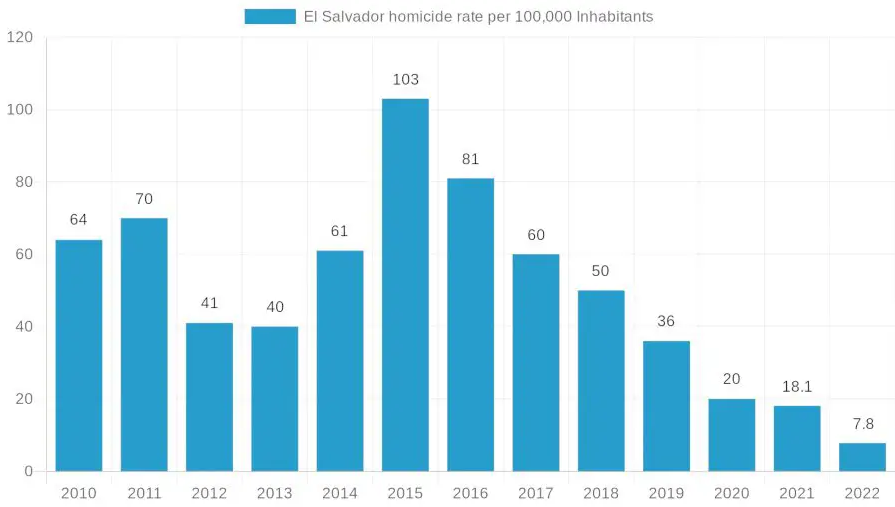

I will also remind crypto-enthusiasts that El Salvador became known for its very tough, but highly effective, approach on law and order – not for its experiments with Bitcoin as a legal tender.

Nobody in El Salvador and nobody relevant outside El Salvador praises President Nayib Bukele for his crypto policy. But everyone is curious how the murder rate dropped by more than 50% in a single year and by more than 1300% in the last 7 years. THAT is interesting and a stunning accomplishment to study! Cryptocurrency marginal nerd stuff? Not so much.

To sum up

Dedollarization as a phenomenon is neither new nor something necessarily scary. In fact, Brazil in 2013 (also under the same far-Left corrupt leadership) signed an even bigger treaty with the CCP also with the intent to bring about dedollarization. Does anyone even remember that one? It’s certainly nowhere to be found on the graphs concerning global trade, so we can safely say it was all panic porn and/or good ol’ propaganda.

Other countries, such as Chile and Israel (in the 1990s) have adopted measures to reduce their direct exposure to the US Dollar in order to reduce market volatility and increase macroeconomic stability and investor confidence. The results were somewhat mixed if judged by the stated objectives but one thing is certain: None of them stopped trading in dollars. In fact, they both trade in dollars more today than before their “dedollarization” policies were implemented.

For all intends and purposes, the US dollar’s dominance is here to stay. This will change if and only if a freely traded and convertible alternative will appear and only if that alternative will gain enough confidence of enough people and entities and that alternative will be usable widely and easily for trade, reserves and finance. All of these conditions have to be met cumulatively.

That alternative might as well be the yuan. But might as well be the Indian ruppee (given that India’s economic growth is much more sustainable). But that’s way too much into the future and any prediction made now will only turn true by sheer luck. Don’t let anyone tell you otherwise!

Assuming things don’t get worse in CCP-land, the growth in Chinese trade will eventually lead to the yuan growing in importance – in the sense of going from 4%-ish now to… maybe 7 or 8, possibly outpacing the Euro. But the road to replace the US dollar is far longer and that assumes the US will always be under incompetent management as it is now.

Oh, and let’s not forget the real global currency – SDR (code XDR). Currently, the XDR basket consists of the following five currencies: U.S. dollar 43.38%, euro 29.31%, renminbi/yuan 12.28%, Japanese yen 7.59% and British pound sterling 7.44%. So, in other words, US-aligned interests hold 87.72%. I’d say the Empire is in good shape.

It took two world wars, multiple genocides, the slow-motion train-wreck of “decolonization” and quite a few other shocking financial events to finally dethrone the British pound sterling from its status as the main global currency. And, even now, it’s still relevant. Dethroning the dollar will be at least equally hard.

Governments and politicians (alongside their shills and some moneyed interests) will grumble, will whine, will complain, will grandstand, will throw a temper tantrum (see Putin) but, when push comes to shove, they will still be more likely than not to be using the US dollar as the global reserve currency for many, many years to come. Что делать? Нечего делать 🤷🏻♂️